In a world where digital assets are quickly becoming a cornerstone of global finance, the United States stands at a crossroads. The Trump administration has repeatedly emphasized its dedication to making everyday Americans more prosperous. From pledging to restore economic strength on the campaign trail to appointing forward-thinking advisors, the White House seems poised to usher in a new era of financial freedom. But if President Trump truly wants to supercharge wealth creation for average citizens—and establish the U.S. as the world’s leading “Bitcoin Superpower”—his administration must embrace a bold, transformative policy: eliminate capital gains taxes on Bitcoin.

The Winds of Change: Lessons from Abroad

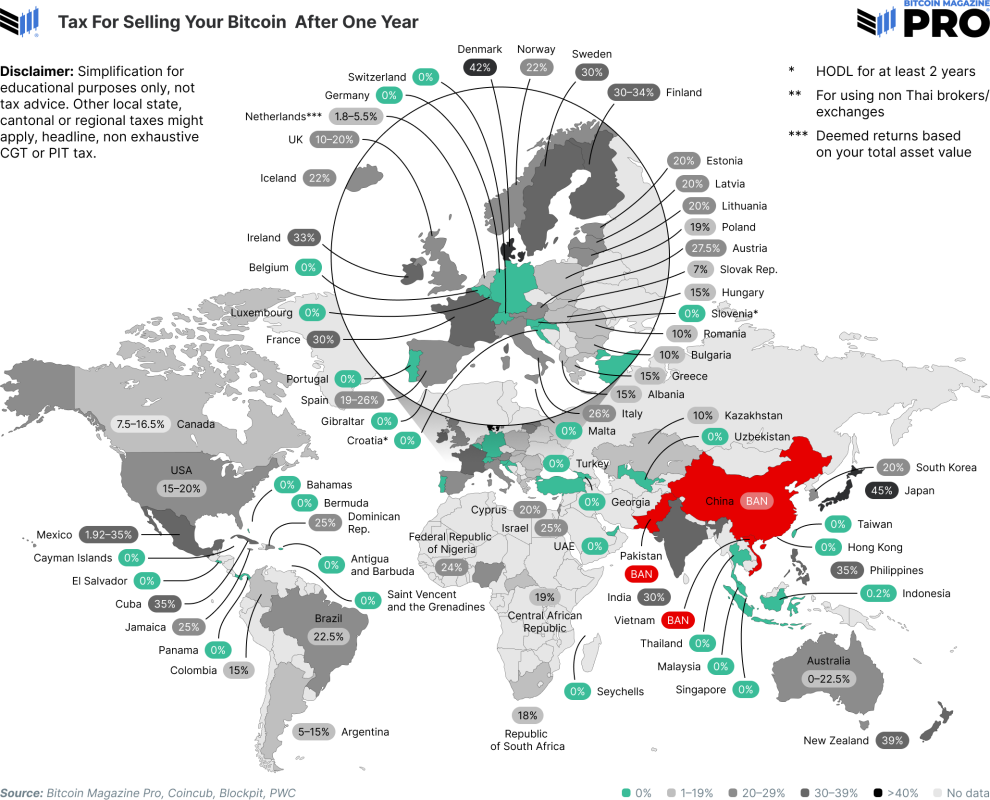

The Czech Republic recently made headlines when its Parliament overwhelmingly voted to exempt capital gains from Bitcoin and other crypto-asset sales from personal income tax—provided they’re held for more than three years and meet certain income thresholds. This is not an isolated event. Countries like Switzerland, Singapore, the United Arab Emirates, El Salvador, Hong Kong, and parts of the Caribbean have long recognized that zero or minimal capital gains taxation on Bitcoin can help spur adoption, financial innovation, and consumer confidence.

As John F. Kennedy famously said, “A rising tide lifts all boats.” If we apply that logic to economic growth through Bitcoin, the tide is global—and it’s rising fast. In a sea awash with global liquidity and debt, America’s economic ship must navigate these digital currents. These nations’ policy choices—and their citizens’ increasing prosperity—send a powerful signal: The U.S. can and should leverage Bitcoin as a tool for growth, not burden it with outdated taxation models.

Trump’s Own Words: A Path to Prosperity

President Trump himself has indicated a willingness to rethink Bitcoin taxation. “They have them paying tax on crypto, and I don’t think that’s right,” he said in a recent interview, echoing the frustrations of millions of Americans who find it absurd to pay capital gains taxes after using Bitcoin to purchase something as small as a cup of coffee. “Bitcoin is money, and you have to pay capital gains tax if you use it to buy a coffee?” he asked rhetorically, highlighting how current laws discourage everyday transactions. He added, “Maybe we get rid of taxes on crypto and replace it with tariffs.”

This sentiment isn’t just rhetorical flourish. Trump, who spoke at the Bitcoin 2024 Conference in Nashville, proclaimed his vision for America to become the world’s “Bitcoin Superpower.” He’s also pledged to “Make Bitcoin in America,” turning the U.S. into a leading hub of Bitcoin innovation. Moreover, he appointed former PayPal Chief Operating Officer David Sacks as his ‘White House A.I. & Crypto Czar’ on December 5—a move widely seen as a step toward implementing forward-looking crypto policies.

The BITCOIN Act of 2024: A Strategic Reserve for the People

The U.S. has already taken monumental steps in this direction. The BITCOIN Act of 2024 mandates that all Bitcoin held by any federal agency be transferred to the Treasury to be held in a strategic Bitcoin reserve. Over five years, the Treasury must purchase one million Bitcoins, holding them in trust for the United States. This government-level accumulation shows a long-term vision for incorporating Bitcoin into national financial strategy. But why stop there? Eliminating capital gains tax on Bitcoin would create a positive feedback loop between national policy and personal prosperity. As the federal government invests and holds Bitcoin, private citizens could do the same without facing punitive tax obligations.

Serving the Everyday American

For everyday Americans, the cost of living and the sting of inflation were focal points of President Trump’s reelection campaign. Traditional strategies—interest rate manipulations, quantitative easing—often amount to rearranging deck chairs on a sinking ship when confronted with truly systemic economic challenges. Bitcoin offers a life raft—dare we say, a digital Noah’s Ark—for Americans trying to preserve and grow their wealth against the erosive forces of inflation. Removing capital gains taxes on Bitcoin would allow citizens to transact, invest, and save in a stable, finite asset without the drain of federal taxes on every incremental gain.

The ripple effect here is clear: More people adopting Bitcoin as a store of value and medium of exchange means stronger demand, which could further buttress the U.S. Treasury’s strategic holdings. It’s a virtuous cycle, a positive feedback loop. As Bitcoin’s value grows, so does the nation’s wealth base—helping pay down national debt, bolstering the dollar’s hegemony in global trade, and genuinely making Americans richer and more secure.

Why America Needs Bitcoin

Bitcoin is no longer a niche experiment reserved for a small band of enthusiasts. It has evolved into a mainstream, urgent priority for everyday Americans—especially the rising generation that will shape our nation’s future economy. This is not some ideological plea; it’s a practical, data-backed reality. According to the Stand With Crypto Alliance, a non-profit dedicated to transparent blockchain policies, more than 52 million Americans now own some form of cryptocurrency. Nearly nine in ten Americans believe the financial system needs updating, and 45% say they would not support candidates who stand in the way of crypto innovation. These numbers represent a sweeping, cross-partisan groundswell: Stand With Crypto’s research shows that 18% of Republicans, 22% of Democrats, and 22% of Independents hold crypto. This cuts through the usual tribal politics and points to a fundamental truth—Bitcoin is now a national policy talking point, not a side note on a fringe agenda.

The demand for America to lead is clear. 53% of Americans want crypto companies to be U.S.-based, ensuring that technological innovation and the wealth it generates remain on home soil. Among Fortune 500 executives, 73% prefer U.S.-based partners for their crypto and Web3 initiatives, signaling a corporate desire to keep America at the forefront of global financial progress.

Failing to act now risks a replay of past mistakes. America once led the world in advanced manufacturing, yet today 92% of the most sophisticated semiconductor production sits in Taiwan and South Korea. We cannot afford to cede the future financial landscape to other regions. Bitcoin isn’t just another investment class; it is the digital backbone of a rapidly evolving monetary system. If the U.S. wants to preserve its economic hegemony, maintain innovation leadership, and ensure everyday Americans have access to a stable, growth-oriented financial future, it must embrace Bitcoin wholeheartedly. In doing so, the nation can secure its place as the global Bitcoin superpower—uplifting our citizens, strengthening our economic base, and safeguarding our strategic interests in the 21st-century digital economy.

America, Charting the Course

By aligning with global best practices and enacting forward-thinking policies, the U.S. can position itself as a beacon of financial liberty and technical innovation. Eliminating capital gains tax on Bitcoin would signal to investors, entrepreneurs, and everyday citizens that America is serious about leading in the 21st century’s digital economy. It’s not just about being “Bitcoin-friendly”; it’s about ensuring that average Americans have the tools they need to navigate turbulent economic waters.

The complexity and inefficiency of taxing every digital transaction is an unnecessary burden on innovation and everyday life. Americans deserve better—they deserve the freedom to transact in a digital world without punitive oversight.

In essence, this is America’s chance to do what it has always done best: innovate, adapt, and lead. Removing capital gains taxes on Bitcoin wouldn’t just fulfill a campaign promise; it would set the stage for long-term prosperity, empower citizens to secure their financial futures, and cement the United States as the world’s foremost Bitcoin champion. A rising tide, indeed, lifts all boats—and what better vessel to embark upon than a Bitcoin Ark, captained by a visionary administration determined to truly Make America Great Again?

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.